The Big Picture

The news that the U.S. has doubled its tariffs on some Indian goods to 50% sounds like a major disaster. You’d expect the markets to panic and the economy to grind to a halt. But here’s the surprising part: the reaction from the Indian market has been surprisingly calm. Why? Because this isn’t a simple economic story it’s a geopolitical power play, and India’s economy is built to weather this specific kind of storm.

Think of it this way: India is a person with two jobs. The first job, a high-paying one, is in the services sector (things like IT, consulting, and customer support). This is where India makes most of its money. The second job is selling goods (like clothes and car parts) at a local market. The new tariffs are like a new, super-high tax on the goods sold at that market. It’s a painful hit to that second job, but it doesn’t threaten the main source of income. This paper will break down why this is happening and what it means for India and its businesses.

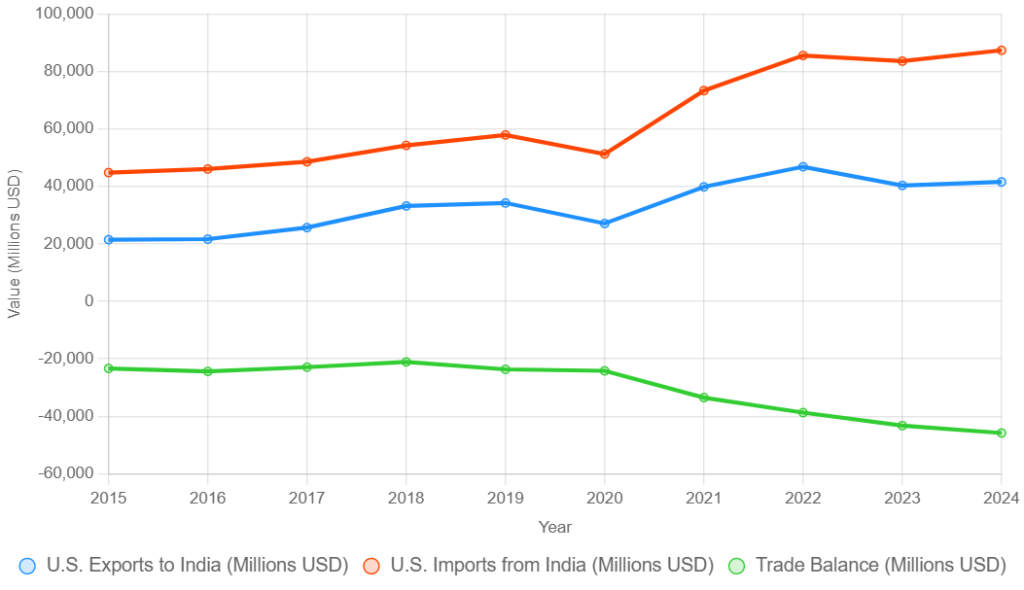

The chart illustrates the growing trade imbalance between the U.S. and India from 2015 to 2024. While U.S. exports to India have increased steadily, imports from India have surged more sharply, widening the trade deficit. This imbalance is often cited as a key justification for recent U.S. tariff hikes.

It’s Not Just About Money: The Geopolitical Story

The first wave of tariffs was about trade imbalances, a classic “America First” move. But this latest, much higher 50% tariff is different. It’s directly tied to politics.

The U.S. is using these tariffs to pressure India to stop buying cheap crude oil from Russia. Before the war in Ukraine, India bought very little oil from Russia. But when Western sanctions hit, Russia started offering big discounts, and India jumped on the opportunity to secure its energy supply. Now, Russia is a primary oil supplier for India. The U.S. sees India’s actions as indirectly funding the Russian war machine and is using these tariffs as a form of leverage to get India to change its foreign policy. This is an unprecedented move that makes trade a tool for international pressure.

“We’re making sure every country respects American interests. If they want access to our markets, they better play fair.”

— Donald J. Trump, Presidential Town Hall, June 2025

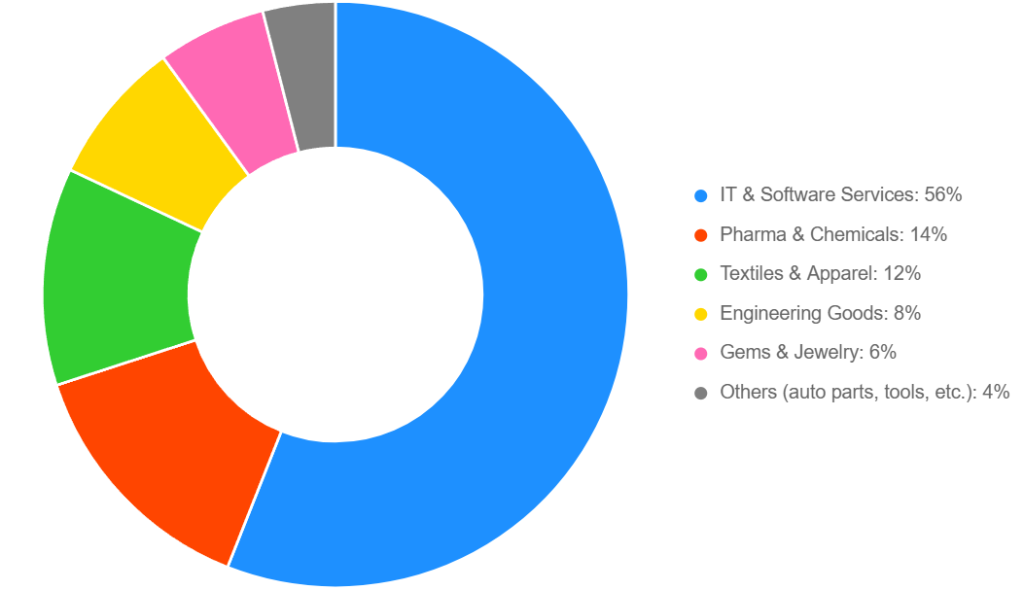

While the 50% tariff appears severe, its impact is limited to physical goods, a smaller component of India’s U.S. exports compared to services.

India’s Export Structure: Manufacturing vs Services

A closer look at India’s export structure reveals why the tariff hike has a limited impact. The majority of India’s exports to the U.S. are in the services sector, which is largely immune to tariffs.

| Export Type | Share of Total Exports | Tariff Impact |

|---|---|---|

| IT & Software Services | 56% | No impact |

| Pharma & Chemicals | 14% | Marginal (some formulations) |

| Textiles & Apparel | 12% | Moderate impact |

| Engineering Goods | 8% | Moderate impact |

| Gems & Jewelry | 6% | Affected, but diversifying |

| Others (auto parts, etc.) | 4% | Impacted |

Source: Ministry of Commerce, Govt. of India, April 2025

This data highlights that tariffs on physical goods only affect a small share of India’s total exports. The services economy, which accounts for more than half of the trade, remains untouched. This inherent structural resilience is the key reason for the muted market reaction.

Market Reaction: From Panic to Pragmatism

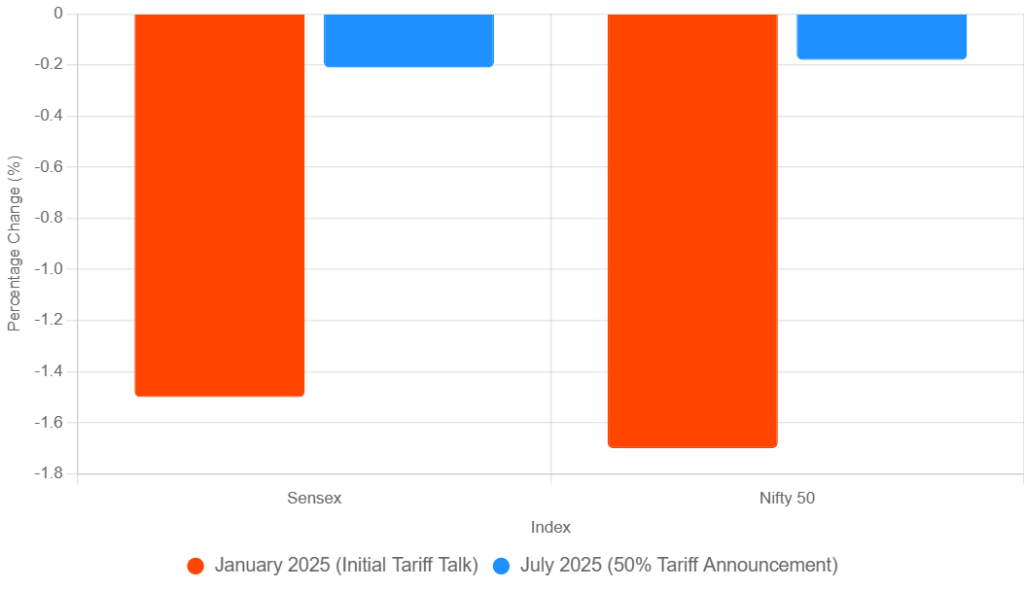

The market’s response to the recent 50% tariff announcement was in stark contrast to its reaction just months prior, demonstrating a shift from panic to pragmatism.

January 2025 (Initial Tariff Talk):

- Sensex fell by 1130 points (-1.5%)

- Nifty 50 dropped by 342 points (-1.7%)

- Major exporters (textiles, gems) saw up to 8–12% declines in a week.

As shown in the graph above, Indian stock indices like Sensex and Nifty 50 dropped sharply during the initial tariff talks in January 2025, but showed minimal reaction when the actual 50% tariff was announced in July highlighting market confidence and reduced fear around the real impact of the hike.

July 2025 (50% Tariff Announcement):

- Sensex dipped -0.21% intraday, closed flat.

- Nifty 50 dipped -0.18%, recovered within the session.

- IT, Pharma, and Banking stocks saw no significant impact.

Market analysts have since concluded that the initial shock was based on a misunderstanding of India’s trade profile. The recent stability is a sign that the market has “priced in the reality” that this is not a broad-based trade war.

“The markets have priced in the reality: this is not 2018’s China-style tariff war. India isn’t in the manufacturing export game like China is.”

— Siddharth Rao, Equity Strategist, JM Financial

Is the Tariff Hike a Geopolitical Chess Move?

The move has more symbolic and strategic weight than actual economic effect. This escalation appears to be a geopolitical tool, rather than a purely economic one, aimed at three primary objectives:

A. Political Messaging to U.S. Voters: Trump is likely positioning himself as a strong negotiator, penalising countries he views as “benefiting unfairly” from U.S. markets. India, despite its relatively limited trade imbalance, becomes a convenient headline to signal a “tough on trade” stance.

B. Strategic Pressure on India: India’s continued proximity to Russia primarily through its purchases of discounted oil and its neutral stance on global conflicts make it a target for subtle coercion. These tariffs may be a tool to push India closer to the Western bloc and weaken its ties with Moscow.

C. Leverage Ahead of Trade Talks: The U.S. and India are in ongoing trade negotiations. This escalation could be used as leverage to extract favorable terms from New Delhi on politically sensitive issues such as pharmaceuticals, e-commerce data localisation, and defense procurement.

Ground Reality for Indian Exporters

While the broader economy remains stable, some niche export segments do face headwinds. Textile and leather exporters from Tamil Nadu and Gujarat have reported a 15–20% drop in U.S. orders, and some auto component suppliers are exploring manufacturing relocation to ASEAN nations. Jewelry exporters are also pushing aggressively into the UAE and European markets to diversify their risk.

However, the services sectors India’s real export engines remain unaffected. For a software firm, for example, the tariff is effectively “tariff-proof,” and its U.S. business remains secure.

Conclusion: A Strategic Storm, Not an Economic Earthquake

The 50% tariff hike by the U.S. is loud, but largely hollow in terms of economic disruption to India. Its impact is limited to a small subset of exporters, while the core strength of Indian trade its vast services sector remains untouched. Indian markets, now more resilient and data-driven, have largely moved on from the initial shock. Business leaders and policymakers should treat this less as an economic threat and more as a clear signal of shifting global power dynamics.