Listen to this article

In today’s dynamic business landscape, growth often hinges on strategic expansion. For discerning business leaders, the question isn’t merely “Should we acquire?” but rather, “How do I find the right company to buy that fits our strategy?” This critical inquiry moves beyond opportunistic deal-making to a deliberate, data-driven approach that ensures long-term value creation. Companies that successfully navigate this complex terrain understand that alignment with core strategic objectives is paramount.

The Imperative of Strategic Alignment in Acquisitions

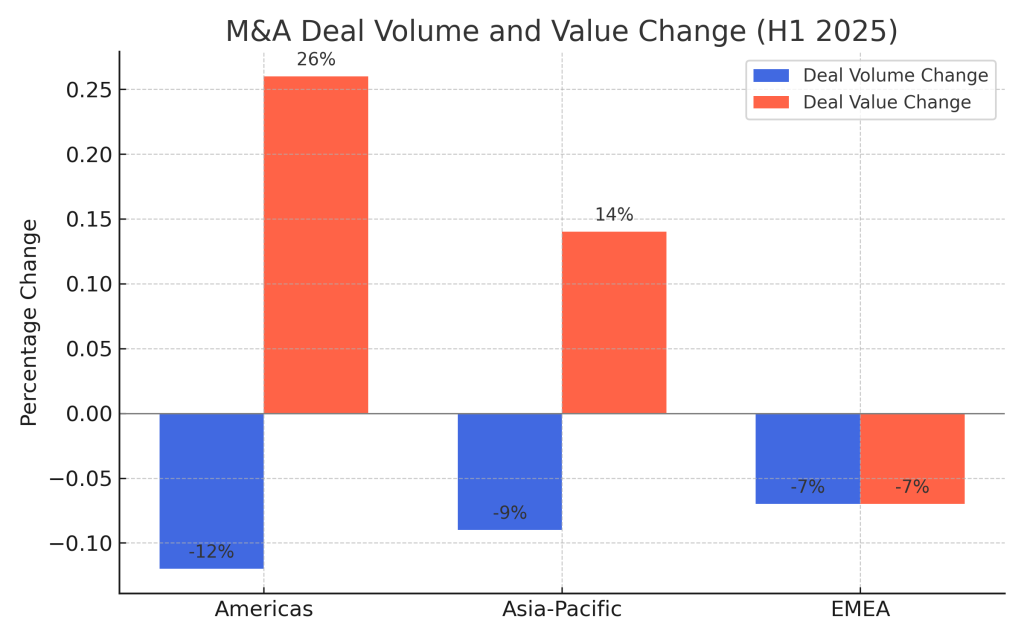

Many M&A failures stem from a lack of strategic alignment, leading to integration nightmares and value destruction. A 2025 PwC mid-year outlook highlights that while M&A values remain high for quality companies, lower-quality assets struggle, emphasising the “flight to quality.” This indicates that merely acquiring for scale is insufficient; the target must truly complement and accelerate your existing strategic goals.

Consider a company aiming to expand its market share. Acquiring a competitor with a strong regional presence but a weak product portfolio might not be the right company to buy that fits their strategy. Conversely, a smaller, innovative firm with a niche product could provide the vital technological edge or customer base needed. The core problem for many organisations is often a reactive approach to M&A, driven by market noise rather than a clear strategic roadmap.

Unveiling the Ideal Acquisition: A Data-Driven Approach

Finding the right company to buy that fits your strategy demands a methodical and analytical framework. This involves comprehensive research and a deep understanding of your own strategic imperatives.

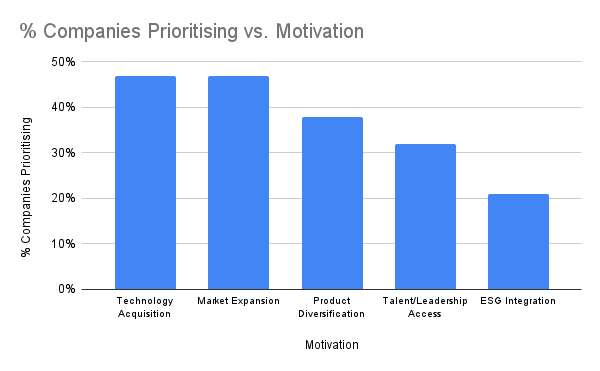

1. Define Your Strategic North Star: Before looking outward, clearly articulate your internal strategic objectives. Are you seeking to: Expand into new geographic markets? Acquire new technologies or capabilities? Achieve economies of scale and cost synergies? Diversify your product or service offerings? Enhance your competitive positioning? Secure critical talent or intellectual property?

According to a Deloitte report, over 50% of companies pursue M&A to expand into new markets and enhance product offerings. This emphasises the need for clearly defined objectives.

2. Develop Rigorous Target Criteria: Translate your strategic objectives into concrete acquisition criteria. This goes beyond financial metrics. You must also consider:

- Market Position and Growth Potential: Is the target a leader in a growing segment? What is its market share? (Source: LawCrust Legal Services)

- Financial Health: Beyond revenue and profit margins, examine cash flow, debt ratios, and historical performance. Will this acquisition be profitable and financially sustainable? (Source: Ideals VDR)

- Technological Fit: Does the target possess proprietary technology or R&D capabilities that complement or enhance your own?

- Operational Synergies: Can you integrate supply chains, production processes, or sales channels for greater efficiency?

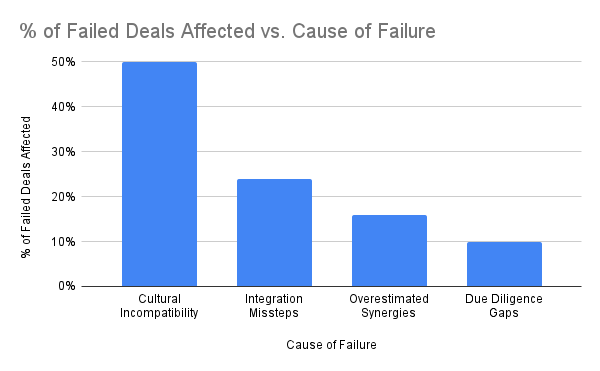

- Cultural Compatibility: PwC’s research indicates that cultural integration is the most significant barrier to successful M&A, with 50% of executives citing it as a primary concern. A good cultural fit can ease the transition and prevent disengagement. (Source: PwC, Value Consulting)

- Talent Acquisition: Does the target bring key leadership or specialised talent that would be difficult to build organically?

3. Leverage Data and Analytics for Identification: Modern M&A is increasingly data-driven. Employ advanced analytics to identify potential targets that align with your strategic criteria.

- Market Mapping: Utilise industry reports (e.g., from McKinsey, BCG, Deloitte) to map out the competitive landscape, identify emerging trends, and pinpoint attractive sub-sectors.

- Financial Screening: Use financial databases and tools to filter companies based on revenue growth, EBITDA, profit margins, and other relevant KPIs.

- Proprietary Deal Sourcing: Actively engage industry networks, investment bankers, and M&A advisors who specialise in your target sectors.

- Scenario Planning: As highlighted by PwC’s 2025 M&A outlook, systematically map out a range of outcomes (macroeconomic, regulatory, geopolitical) to understand how different variables could affect the target’s performance and valuation.

Expert Insights on Navigating the Acquisition Journey

“Finding the right company to buy that fits our strategy isn’t about chasing every opportunity,” says a leading M&A advisor. “It’s about disciplined execution of a well-defined strategic roadmap. Companies that succeed have a crystal-clear understanding of the value they want to create and then meticulously identify targets that can deliver on that vision.”

Another industry expert emphasises, “Post-merger integration often makes or breaks an acquisition. Even if you find the right company to buy that fits your strategy on paper, neglecting cultural integration or operational alignment will quickly derail your efforts. Proactive planning for integration, starting from the due diligence phase, is non-negotiable.”

Real-World Examples of Strategic Acquisitions

The strategic acquisition of WhatsApp by Facebook (Meta) in 2014 for $19 billion exemplifies gaining access to new customer bases and platforms. Facebook’s strategic rationale was clear: solidify its position in the messaging space and acquire a rapidly growing user base. Despite the hefty price tag, the acquisition proved strategically sound, integrating WhatsApp into Meta’s ecosystem and expanding its global reach. This was not a random purchase; it was a deliberate move to find the right company to buy that fit Meta’s long-term vision for social connectivity.

Similarly, Microsoft’s 2022 acquisition of Activision Blizzard for $68.7 billion aimed to dominate the gaming and metaverse landscape. Microsoft’s goal was to expand its content library, strengthen its Xbox ecosystem, and position itself at the forefront of emerging digital entertainment trends. This massive deal reflects a clear strategy to find the right company to buy that fits their ambitious growth plans.

Future Trends and Implications for M&A

The M&A landscape continues to evolve, shaped by technological advancements, geopolitical shifts, and a renewed focus on sustainability.

- AI and Machine Learning: Expect continued M&A activity driven by AI, with companies seeking to acquire AI agents, talent, and infrastructure across the AI value chain. Strategic investments in AI capabilities will be key to finding the right company to buy that fits future innovation needs. (Source: PwC 2025 M&A Outlook)

- ESG Integration: Environmental, Social, and Governance (ESG) factors are becoming central to M&A decisions. Acquirers increasingly prioritise targets with strong ESG practices to align with regulatory standards and investor expectations. This means that to find the right company to buy that fits your strategy, you will need to consider their sustainability profile.

- Cross-Border Expansion: As globalisation progresses, cross-border M&A transactions are expected to rise. Firms will increasingly look globally to find the right company to buy that fits their international expansion strategies.

- Sector Consolidation: Many industries will see further consolidation as companies seek scale to thrive in competitive landscapes. This drive for efficiency and market dominance will prompt strategic acquisitions.

Actionable Takeaways for Business Leaders

- Develop a Robust M&A Strategy First: Do not pursue acquisitions reactively. Clearly define your strategic objectives and how an acquisition will accelerate them. This is the foundational step in how to find the right company to buy that fits your strategy.

- Embrace Data-Driven Decision Making: Utilise market data, financial analytics, and strategic frameworks to identify and evaluate potential targets. This systematic approach helps you find the right company to buy that fits your specific needs.

- Prioritise Cultural Due Diligence: Cultural misalignment is a major deal-breaker. Assess cultural compatibility early in the process to ensure a smoother integration.

- Plan for Integration from Day One: Successful acquisitions are not just about closing the deal; they are about seamless post-merger integration. Develop a comprehensive integration plan covering operations, technology, and human capital.

- Engage Expert Advisors: Leverage the expertise of investment bankers, legal counsel, and M&A consultants to navigate the complexities of the acquisition process. Their insights are invaluable in helping you find the right company to buy that fits your strategy.

A Forward-Looking Conclusion

The strategic pursuit of growth through acquisition is no longer a luxury but a necessity for many organisations. As market dynamics shift and competition intensifies, the ability to find the right company to buy that fits your strategy will remain a defining characteristic of successful, forward-thinking businesses. By embracing a disciplined, data-driven, and strategically aligned approach, leaders can unlock significant value, drive innovation, and forge a resilient path toward future prosperity. The companies that master this strategic compass will undoubtedly lead the way in the evolving global economy.