Listen to this article

Thinking about selling your company? It’s a pivotal moment, and while the idea of a lucrative exit is exciting, many business owners leave significant money on the table. You’ve poured your heart and soul into building your business, and now, it’s time to ensure you maximise company valuation during the sale. We’re talking about getting every dollar your company truly deserves, not just settling for an offer.

The Challenge: Selling Short of Your Potential

The biggest hurdle for many sellers is a lack of preparation and a clear understanding of what drives buyer interest and, consequently, value. Without a proactive strategy, you risk underselling a business that has far greater potential. Your opportunity lies in meticulously preparing your company to showcase its inherent strengths and future growth prospects, thereby allowing you to maximise company valuation.

Data-Driven Strategies to Maximise Company Valuation

To truly maximise company valuation, you need to demonstrate tangible value to potential buyers. Here’s what the data suggests:

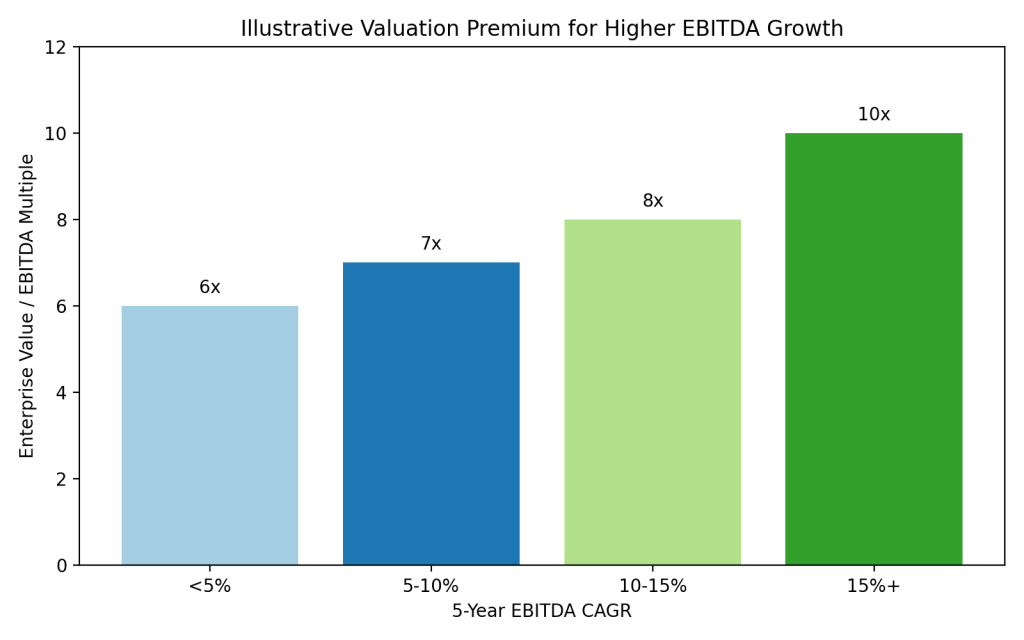

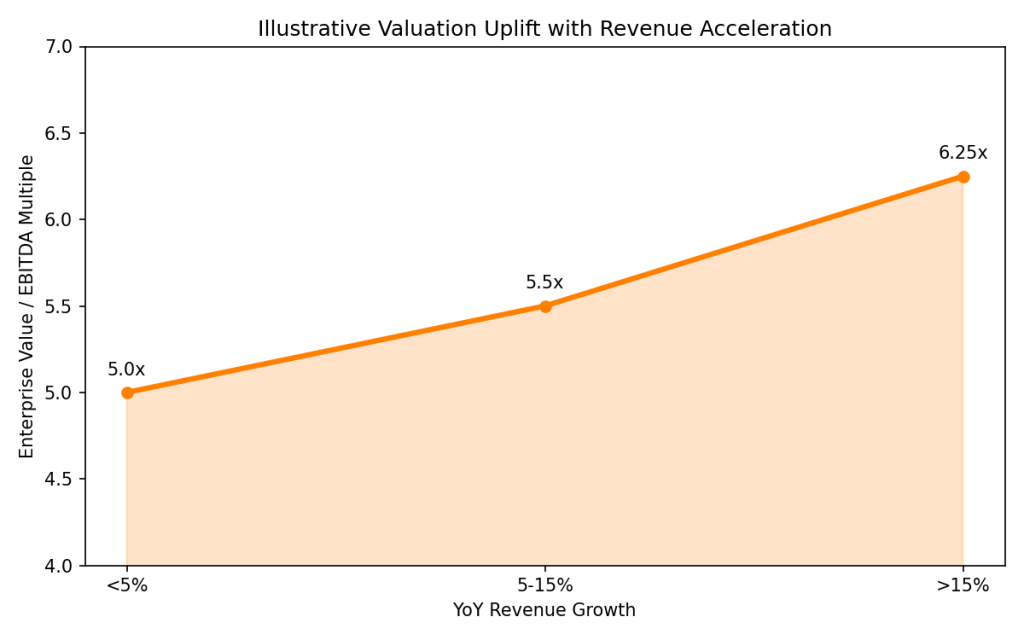

- Financial Performance is King: Companies with consistent, strong profitability and predictable revenue streams command higher multiples. According to a recent analysis by PwC, businesses with a five-year compound annual growth rate (CAGR) exceeding 15% often see valuations 20-30% higher than their slower-growing counterparts. Focus on showcasing robust EBITDA and clear revenue acceleration.

- Recurring Revenue Drives Premium: Buyers love predictability. Businesses with a high percentage of recurring revenue (e.g., subscription models, long-term contracts) are often valued at 3x to 5x higher multiples than project-based businesses. McKinsey reports that SaaS companies, for instance, frequently achieve valuations of 8x to 12x their annual recurring revenue (ARR) at acquisition. This significantly helps maximise company valuation.

- Operational Efficiency Matters: Lean operations and strong gross margins directly impact your bottom line and, in turn, your valuation. Deloitte’s M&A insights indicate that companies demonstrating best-in-class operational efficiency can achieve up to a 15% premium on their valuation due to lower perceived risk and higher future profit potential.

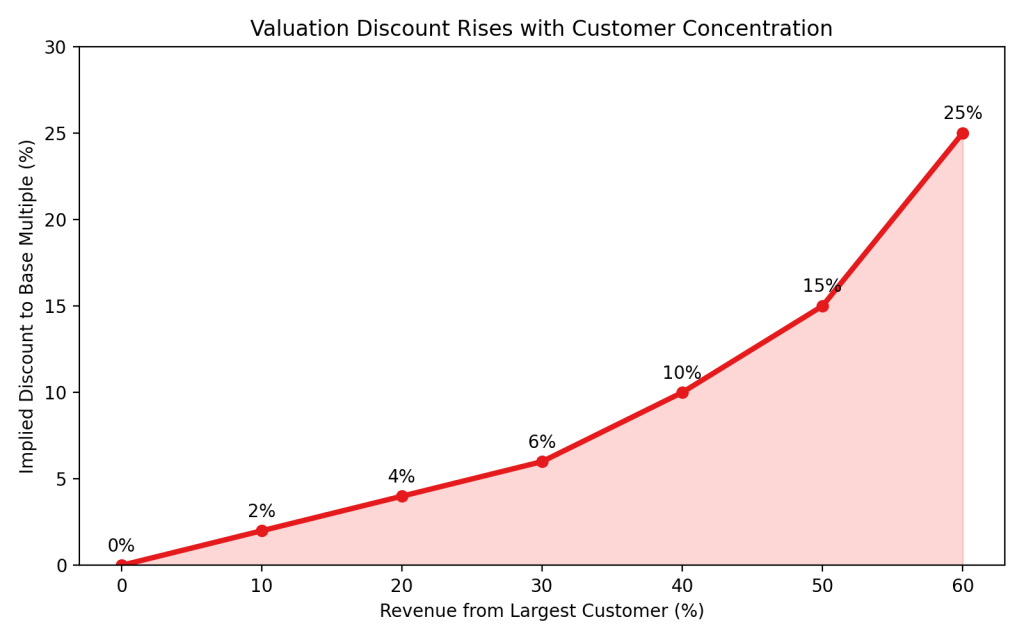

- Customer Concentration Risk: Diversified customer bases are more attractive. A company with 50% or more of its revenue from a single customer can see its valuation discounted by 10-25%. Broadening your customer base reduces risk and helps maximise company valuation. (Source: Industry estimates based on common M&A due diligence findings).

- Intellectual Property (IP) Value: Proprietary technology, patents, and unique processes can significantly boost your company’s worth. A study by Boston Consulting Group (BCG) highlighted that companies with strong, defensible IP portfolios can command valuations 5-10% higher than competitors with comparable financials but less IP. Protecting and highlighting your IP is crucial to maximise company valuation.

Expert Insights on Maximising Value

“Sellers often underestimate the power of a compelling narrative,” advises a leading M&A advisor. “It’s not just about the numbers; it’s about painting a clear picture of future growth and competitive advantage. Proactively addressing potential weaknesses and highlighting unique strengths before going to market is paramount if you want to maximise company valuation.”

Real-World Impact: The Power of Preparation

Consider the acquisition of a niche software company. Before engaging buyers, the founders invested six months in standardising their code, diversifying their client base from 70% reliance on one client to under 30%, and meticulously documenting their sales pipeline. This proactive preparation allowed them to secure an acquisition multiple 40% higher than initial informal offers, showcasing their commitment to maximise company valuation. They focused on optimising their internal systems and market presentation, which paid off handsomely.

Key Strategies to Maximise Company Valuation

- Clean Up Your Books: Before even thinking about a sale, ensure your financial records are impeccable, audited (if possible), and easily digestible. Discrepancies and messy financials raise red flags and can significantly lower your valuation.

- Develop a Robust Growth Story: Buyers invest in the future. Articulate a clear and compelling vision for your company’s growth post-acquisition. Quantify market opportunities, identify new product lines, and demonstrate scalability. This narrative is essential to maximise company valuation.

- Strengthen Your Management Team: A strong, independent management team reduces reliance on the owner and signals stability and continuity to potential buyers. Empower your key personnel and highlight their expertise.

- Diversify Revenue Streams and Customer Base: Reduce concentration risk. Buyers seek stability and resilience. The more diversified your revenue, the more attractive your company. This is a critical step to maximise company valuation.

- Document Processes and Systems: Well-documented operational procedures and scalable systems demonstrate efficiency and ease of integration for a buyer. This institutional knowledge adds significant value.

- Identify and Protect Intellectual Property: Catalogue all your patents, trademarks, copyrights, and proprietary processes. These assets can be a significant differentiator and a key driver to maximise company valuation.

- Build a Competitive Moat: What makes your company unique and defensible? Is it technology, customer relationships, market position, or brand? Clearly articulate your competitive advantage.

- Engage Experienced Advisors: An M&A advisor, legal counsel, and tax specialists are invaluable. They guide you through the complex process, identify potential pitfalls, and help you strategise to maximise company valuation. Their expertise is critical in navigating negotiations and securing the best possible terms.

The Future of Company Valuations: Beyond the Balance Sheet

In the coming years, we anticipate an even greater emphasis on intangible assets in valuations. Brand equity, customer loyalty, data insights, and a company’s environmental, social, and governance (ESG) performance will play an increasingly significant role. Buyers will scrutinise not just what a company has, but what it represents and its potential for long-term sustainable growth. Proactively building and communicating these intangible values will be crucial to maximise company valuation in the future.

Your Action Plan for a Premium Sale

Start preparing early. Don’t wait until you’re ready to sell to begin optimising your company for maximum value. Implement the strategies above consistently. By focusing on financial health, operational excellence, a strong growth narrative, and engaging the right experts, you empower yourself to maximise company valuation and achieve the exit you truly deserve.

The journey to a successful and highly valued sale begins long before you list your company. By proactively implementing these strategies, you position yourself to maximise company valuation and secure a truly rewarding outcome. Don’t just sell your business; sell its full potential.

Leave a Reply