Listen to this article

– 15 minutes

Seamless M&A Integration: Keeping Your People and Operations Intact

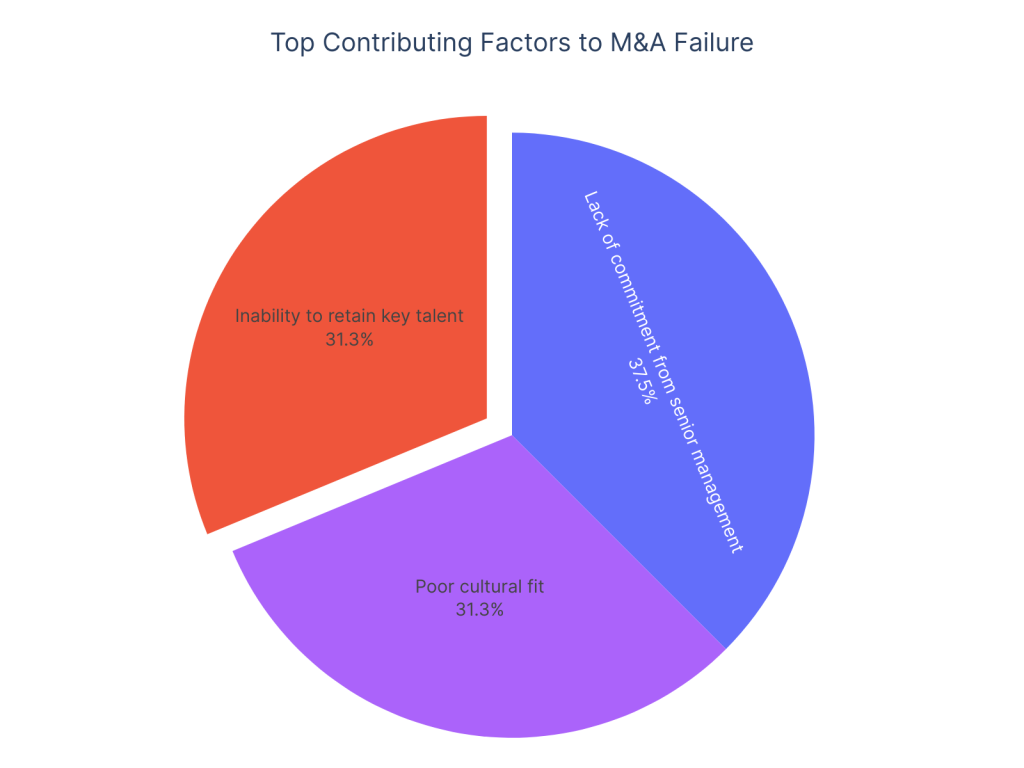

Mergers and acquisitions often promise exciting new horizons expanded market share, innovative capabilities, and enhanced profitability. Yet, the harsh reality is that a significant number of deals falter, not in the negotiation room, but in the crucial post-merger integration phase. Research from KPMG indicates that nearly half of all M&A deals fail to create value, with talent retention and operational disruption cited as primary culprits. The real challenge, and the greatest opportunity, lies in achieving seamless M&A integration without losing your most valuable assets: your people and your productivity.

The Integration Dilemma: People and Performance at Risk

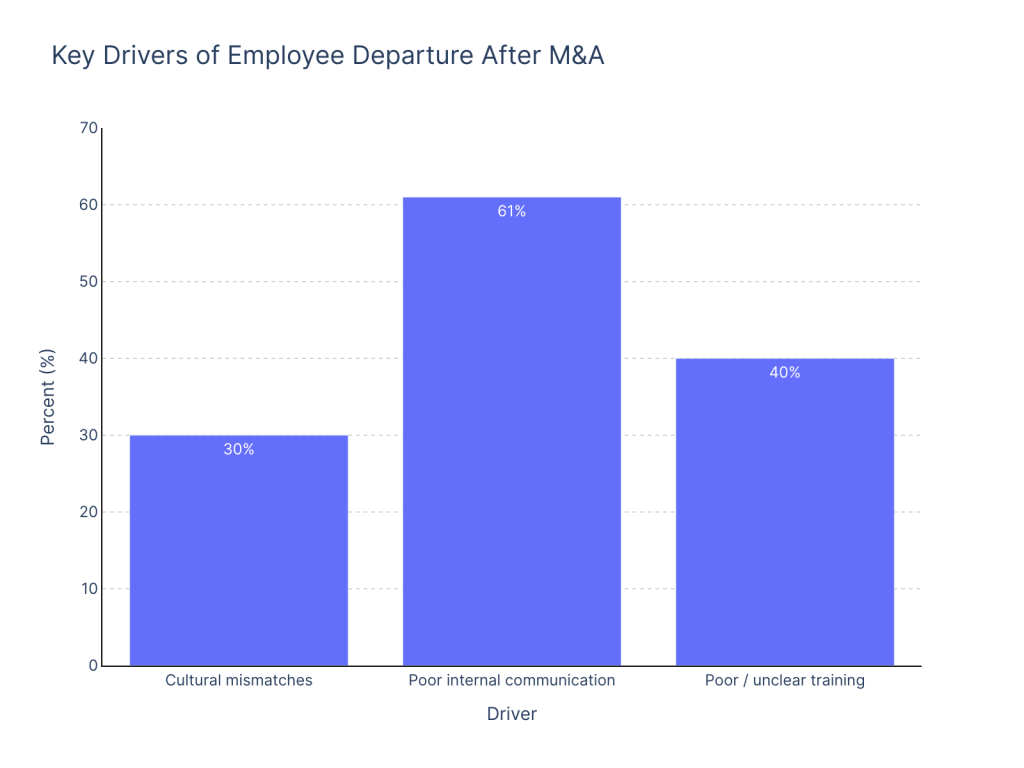

The moment two companies announce a merger, a palpable uncertainty often sweeps through both organisations. Employees worry about job security, cultural clashes, and changes to their work environment. Customers and suppliers, too, can experience apprehension regarding service continuity and future relationships. This human element, if mishandled, can lead to a mass exodus of key talent, a decline in morale, and significant operational bottlenecks. The problem isn’t the acquisition itself, but the lack of a deliberate and empathetic strategy to ensure seamless M&A integration. Without this focus, you risk not just losing talent but also disrupting the very operations you acquired to enhance.

The Blueprint for Harmony: Achieving Seamless M&A Integration

Achieving seamless M&A integration demands a strategic, proactive, and human-centric approach. It’s about meticulously planning every step, from pre-deal due diligence to post-integration stabilisation, with a relentless focus on minimising disruption and maximising synergy.

- Pre-Deal Talent Assessment and Retention Strategy (Know Who You’re Getting): Before the ink even dries, conduct thorough human capital due diligence. Identify critical roles, key leaders, and high-potential employees in the target company. Develop customised retention plans for these individuals, including clear communication on their roles, career paths, and compensation. A Bain & Company study found that companies with a strong pre-deal talent strategy achieve 15% higher post-merger returns. This proactive identification is crucial for seamless M&A integration.

- Transparent and Consistent Communication (Build Trust, Not Rumors): Information vacuums breed anxiety and rumors. Establish a clear, consistent, and frequent communication cadence from day one. Communicate the rationale for the merger, the vision for the combined entity, and what changes employees can expect. Be honest about uncertainties and provide channels for feedback. A survey by Willis Towers Watson revealed that effective communication can improve employee engagement during M&A by up to 20%, directly contributing to seamless M&A integration.

- Cultural Integration and Alignment (Blend, Don’t Blind): Cultural clashes are a leading cause of integration failure. Start assessing cultural fit during due diligence. Post-merger, consciously identify cultural similarities and differences. Develop strategies to bridge gaps through shared values, team-building initiatives, and clearly defined new norms. It’s not about one culture dominating; it’s about forging a new, stronger, combined culture. This deliberate effort is vital for seamless M&A integration.

- Operational Streamlining with Phased Implementation (Evolve, Don’t Disrupt): Avoid immediate, sweeping operational changes. Prioritise critical functions and implement changes in phases. For example, integrate back-office functions like finance and HR first, while allowing front-line operations to continue with minimal disruption. McKinsey & Company emphasizes that a phased approach to operational integration can reduce the risk of revenue erosion by up to 10% during the critical post-merger period. This methodical approach ensures seamless M&A integration.

- Dedicated Integration Management Office (IMO) (The Guiding Hand): Establish a dedicated IMO with strong leadership and clear accountability. This team drives the integration process, monitors progress, identifies roadblocks, and ensures cross-functional coordination. The IMO acts as the central nervous system, ensuring every piece of the puzzle contributes to seamless M&A integration.

Expert Insight: Integration is the New Innovation

“We often say that in today’s M&A landscape, integration is the new innovation,” states Dr. Anya Sharma, a seasoned M&A integration consultant. “Companies that truly master seamless M&A integration gain a significant competitive edge. It’s about designing an experience for employees and customers that is less about disruption and more about enhancement. You can’t just buy a company and expect it to magically work; you must actively integrate it.”

Real-World Relevance: The Salesforce-Slack Example

Consider the acquisition of Slack by Salesforce. While a large deal, Salesforce placed significant emphasis on retaining Slack’s unique culture and product identity. They communicated a vision of “Slack-first” integration, emphasizing how Slack would enhance the Salesforce ecosystem rather than being absorbed entirely. This approach, while complex, aimed to preserve the very elements that made Slack valuable, demonstrating a commitment to seamless M&A integration even at scale.

The Future of Integration: Agile and Human-Centric

Looking forward, the trend in M&A integration will increasingly lean towards more agile, iterative approaches. Technology will play a larger role in identifying integration synergies and managing complex workstreams, but the human element will remain paramount. Companies will focus on building “integration capabilities” within their organisations, allowing for quicker and more effective absorption of new businesses. The emphasis on psychological safety and employee well-being during transitions will become a differentiator for companies striving for seamless M&A integration.

Actionable Takeaways for Business Leaders

- Prioritise People from Day One: Make talent retention and cultural integration non-negotiable priorities throughout the entire M&A lifecycle.

- Over-Communicate, Always: Create a comprehensive communication plan and stick to it. Address concerns proactively and transparently.

- Establish a Robust IMO: Empower a dedicated team with the resources and authority to drive the integration process effectively.

- Adopt a Phased Approach to Operations: Avoid rip-and-replace strategies. Implement operational changes incrementally to minimise disruption.

- Measure and Adapt: Continuously monitor key performance indicators related to talent retention, operational efficiency, and customer satisfaction. Be prepared to adjust your integration strategy as needed.

The Path to Unified Success

The success of any merger or acquisition ultimately hinges on your ability to weave two distinct entities into a cohesive, high-performing whole. By prioritising people, fostering open communication, and adopting a structured yet flexible approach, you can achieve truly seamless M&A integration. This commitment transforms potential pitfalls into pathways for growth, ensuring that your valuable talent stays, your operations hum, and the promise of the deal becomes a vibrant reality.

About LawCrust Global Consulting

At LawCrust Global Consulting, we understand that successful M&A integration is a delicate balance of legal precision, operational efficiency, and human capital management. We partner with business leaders to navigate the complexities of post-merger integration, ensuring that your strategic vision translates into tangible results without sacrificing key talent or disrupting essential operations. Our expertise spans comprehensive legal due diligence, crafting bespoke talent retention strategies, designing phased operational integration plans, and establishing robust communication frameworks. We empower your organisation to achieve truly seamless M&A integration, unlocking the full value of your acquisitions.

Ready to ensure your next merger is a success story? Connect with LawCrust Global Consulting to build a resilient and thriving combined entity.

Contact Us:

Email: inquiry@lawcrustbusiness.com

Leave a Reply